Risk-off tone as traders eye US data backlog and global macro signals

Today’s Market Mood, Key Events, Market Moving News.

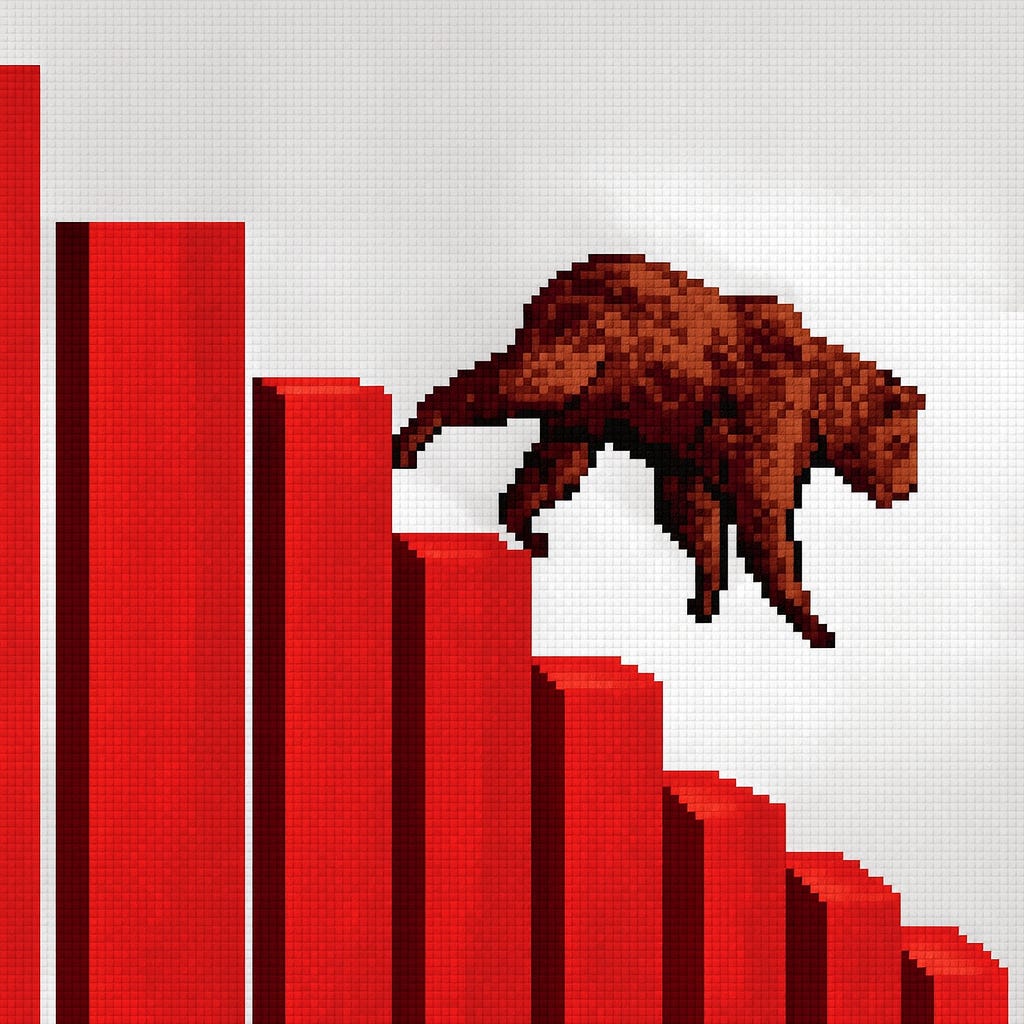

📈 Market Mood:

🔻 Bearish. Rising volatility and soft risk sentiment as markets wait for delayed US economic data.

🗓 Key Events:

No major data today

🌐 Market Moving News:

Stocks slip as global markets brace for a flood of delayed US data.

Japan PM meets BOJ chief amid rising economic pressure.

Oil falls as Russian port operations resume.

Asset Snapshots:

🔴 S&P 500: Bearish - deeper losses as Nvidia earnings risk and US data uncertainty weigh.

⚪ USD (DXY): Neutral - holding steady near 99.5 as markets wait for key data.

🔴 Gold: Bearish - pressured as Fed rate cuts look less likely and real yields stay firm

🔴 Oil: Bearish - pressured by signs of Russian export recovery and global surplus.

🔴 Bitcoin: Bearish - fear returns as traders eye potential drop toward $80,000.

Volatility S&P 500 Index (VIX): 22.39 - rising sharply (+12.97%), signaling elevated fear and positional unwinding.

Macro Bias:

Shows overall bullish, bearish, or neutral trends across major markets based on key economic data. It reflects how indicators like GDP, inflation, employment, retail sales, and PMIs are performing. When data improves, the bias turns bullish; when it weakens, bearish; when mixed, neutral.

Indicies:

🟢 S&P 500: Bullish

🟢 Nasdaq 100: Bullish

Currencies:

🟢 USD: Bullish

⚪ EUR: Neutral

⚪ JPY: Neutral

⚪ GBP: Neutral

🟢 AUD: Bullish

🟢 CAD: Bullish

⚪ CHF: Neutral

Commodities:

⚪ Gold: Neutral

⚪ Oil: Neutral

Crypto:

🟢 Bitcoin: Bullish

🪙 Price Action Notes:

Watch SPX around 6,650 - 6,700 support zone for potential breakdown.

DXY range tight; breakout likely after US data hits later this week.

Disclaimer:

This newsletter is for information only and not financial advice. Markets carry risk, and past performance does not guarantee future results. Always do your own research or consult a qualified advisor before making investment decisions.